This website is not a commercial venture. The use of images is purely educational or for commentary and involves no intention or acceptance of financial gain. No part of this website should be taken as advice. Information, including financial data and derived figures, may be inaccurate. Investing is risky and can cause permanent loss of money.

For an industry overview, click here

Contents

Market Capitalisation: $12mAUD

Industry: Macadamia Products

Description

Health and Plant Protein (HPP) grows macadamia nuts on a Hawaiian orchard and processes them into snack foods for the US market. Their products lean toward the luxury end of the market, but the company has stated an intention to transition toward health centric branding with new products and investments in other businesses.

HPP was split off from the ginger and confectionary company Buderim in 2020 after it had struggled and downsized over the previous few decades. Buderim’s main business and headquarters, also a tourist attraction, were privatised. What remained within HPP were the macadamia brands Royal Hawaiian Orchards and MacFarms, and a macadamia orchard in Hawaii, which had been purchased in 2008 and 2014 respectively.

The company is under financial stress and has been unable to generate consistent profit in their two years of operation.

Management

| Average Tenure | 5yr |

| Industry Experience | Bubs, Select Harvests, Capilano Honey, Cha Cha Food, Buderim |

| Other Experience | Finance & Investments |

| Remuneration | Average $110k, none performance-based |

| Directors’ shareholding at $0.097 | Only one holder, $94kAUD |

Mr Andrew Bond is the only director with a significant shareholding. He is the current CEO of Buderim and was CFO of Buderim from 2014. He, along with Mr Dennis Lin and Ms Qi Chen, implemented the creation of the HPP company.

Mr Dennis Lin is the Executive Chair of HPP and sits on the board of Bubs, a $280m baby formula company.

Ms Qi Chen is based in China and is on the board of the $27b ChaCha food company.

Two directors resigned in 2021.

Strategy

HPP was created with a flexible strategy in mind. With MacFarms product sales providing a base of income, the company wanted to explore new markets and products wherever synergy could be found.

Health food

When the Buderim operation changed their name to Health and Plant Protein, it reflected an intent to pivot into the plant-based food market. This market has forecasted growth at over 10% annually until 2030. Health/plant-based manufacturing has synergy with macadamias, which contain monounsaturated fats, iron, magnesium, and antioxidants.

This strategic transition was further enforced with an investment in LAVAA (17% stake for $3.3m), a company creating dairy free yoghurt from the Pilli nut. It was hoped that the macadamia could be used in LAAVA’s product creation. Unfortunately, LAVVA has failed to generate positive returns- they recalled a product in February 2021 due to mould contamination fears, and HPP have fully written off the investment.

HPP have stated an intention to produce a health-based line of products within the Mac Farms brand. This has not so far eventuated, and the strategic focus on health food appears to have faded somewhat in recent quarters.

Macadamias

HPP earn most of their income from macadamias. Most are grown on their Kapua Ranch Orchard on the island of Hawaii, but the company has also purchased kernels externally to fulfill orders. Sources of revenue include packaged premium snack foods and ingredient sales (macadamia flour, oil).

The company aims to partially sell this property but retain a stream of the crop. A revaluation last year quoted the property worth $33m USD.

Asia

Directors have special Asian experience and are pursuing sales in Asian markets. This strategy took effect in early 2022 with sales to Japan and more recently Korea.

Quality of Earnings

Macadamia

HPP’s Royal Hawaiian Orchards and MacFarms macadamia products are whole macadamia kernels with alterations like a chocolate coating or added flavour. The final product sells for around $24USD per pound, while the global price of macadamia kernels is around $11 per pound.

Products are sold in major food stores (Walmart, Costco) and online.

Online sales appear genuinely successful. For their Dry Roasted product, they received 4.8/5 (113 ratings, 2300 sales) on eBay, 4.7/5 (5200 ratings) on Amazon, and 9.4/10 (1375 ratings) on BestViews Reviews, the top macadamia product ranked.

Macadamia operations have not yet shown true profitability. Sales fell at the beginning of COVID, which occurred at the same time as Buderim’s transition to HPP. More recent quarters were depressed due to higher-than-expected inventory management costs.

2020 saw $42m in macadamia revenue at a cost of $38.5m. 2021 revenue was $36m, costing $41m.

On balance, HPP have a strong product that should be capable of delivering positive income over time. Macadamia demand growth is expected but at this stage long term positive cash flow is the more important goal.

Health food

So far, this has not provided success. No health or diet-based products are yet launched, and LAVVA has been written off. While the health food market anticipates strong demand, gaining the momentum required to be successful is difficult. It usually requires a strong brand, high marketing costs, and a unique product that people enjoy. Trying to tick all these boxes is a prospect with a high chance of failure, and the costs of marketing and launching the product are unrecoverable in a failure. Despite the company name, recent lack of coverage on this pursuit may suggest that the company is stepping away.

Orchard

Growing macadamia nuts has been a profitable operation for most participants over the past few decades- supply limitations have meant that the global market price has consistently increased. However, recently things have changed. Supply has ramped up in South Africa and China, where labour costs (currently elevated globally) are lower. The macadamia kernel is a generic product.

HPP’s orchard has reportedly grown in value- the biological asset, macadamia trees, are worth more than they were in 2014, as is the land on the big island of Hawaii. Last year, the orchard was evaluated to be worth $33mUSD.

The company has communicated that negotiation of selling the orchard is ongoing. They aim to retain a portion of the yearly crop to continue production of packaged macadamias.

Capital Allocation

Since 2016, neither Buderim nor HPP have earned a positive return on invested capital.

Investments

Buderim’s purchase of Macfarms and the Kapua Orchard cost $5 and $4.5m respectively. Each investment has performed well, appreciating significantly in value, but they were not initiated by HPP’s current management.

LAAVA cost the company $3.5m. Whether due to poor market conditions, a product recall, or an inferior product, this investment has failed and is now worth nothing.

Core Capacity

The purchase of plant and equipment has occurred on an ongoing basis to increase manufacturing capacity, $925k in FY21 and $1.1m in 2022. This has not yet translated into increased revenue on an annual basis. The company have been able to sell new ingredient products, however, diversifying their income.

Financing

To fund their activities, HPP has borrowed and issued equities.

They have interest-bearing loans worth $18.6m, and a debt-to-equity ratio of 94.1%. Debts have been restructured frequently, with allowances made by lenders presumably due to the companies potentially positive cash flow and tangible orchard asset.

The total shares outstanding is 122m, compared to 90m in 2020. Previously, Buderim had also issued significant equity, increasing the share count approximately 300% in 10 years.

HPP have not paid dividends or repurchased stock to return value to shareholders.

Valuation

Asset basis

A condensed summary of the company’s balance sheet:

| Assets: | $000AUD |

| Cash | 1,957 |

| Inventory (finished product, harvested and unharvested nuts) | 15,896 |

| Reported property plant and equipment | 26,879 |

| Total | 44,732 |

| Liabilities | |

| Borrowings | 10,868 |

| Convertible note principal | 10,000 |

| All other liabilities | 8,655 |

| Total | 29,523 |

| Net Assets | 15,209 |

On a strict net asset basis, HPP are worth $15.2m- a little more than their current market capitalization of $11.8m.

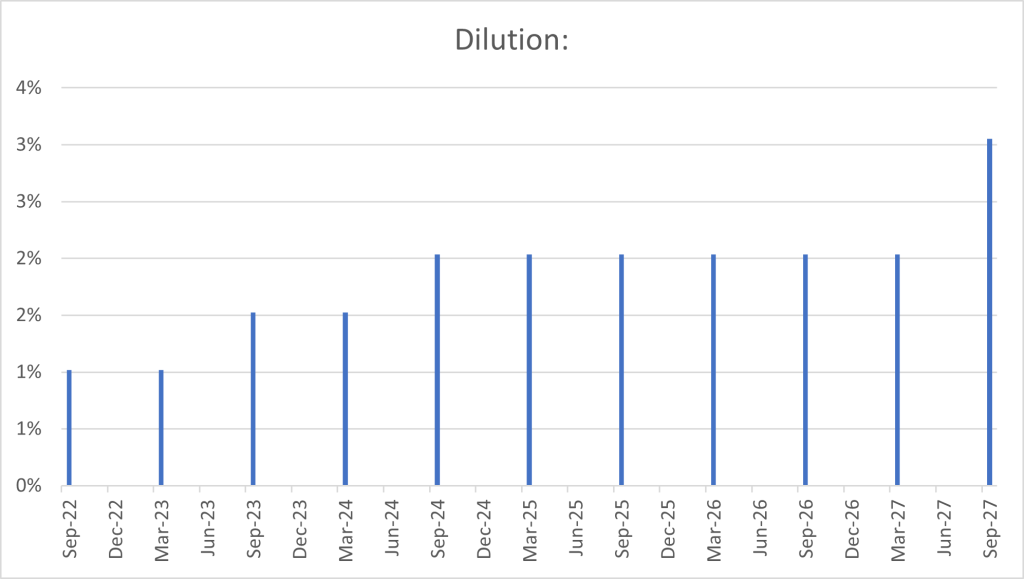

Their reported assets, however, do not include the revaluation of Kapua Orchard, which was $45.79m last year, and the value of the convertible note principle does not truly reflect the impact of that liability. Rather, the convertible notes represent a liability of 4.5% of profits annually and a 20% dilution on the share price to occur in the next five years on the following schedule:

A different perspective would include the revaluation of the Kapua Orchard. The balance sheet value of the company’s land was $19.9mAUD in June 2020, meaning a difference of $24.8m versus the current orchard valuation. Adding this to the net assets of the company means a value of $40mAUD. Adding the $10m convertible note principal back, then subtracting 20% for dilution 4.5% of profit from the orchard sale (convertible note effects) yields a net asset value of $37.9m.

Earnings basis

On an earnings basis, we can work backwards to assess whether HPP are well valued by taking the market capitalization and assigning an inflationary equivalent growth PE (10). At $12m market cap, the company is required to make a net profit of $833k, or $873k to compensate for the 4.5% convertible note coupon. With $30-40m in annual revenue, this requires a net profit margin of 2.5-3%.

In assessing the likelihood of HPP achieving this target, risks must be considered. The company must generate income from the macadamia segment, which is susceptible to bad harvests and natural disasters. Food products can meet adversity, as seen in LAAVA, that result in ruined inventory and a damaged brand. MacFarms brand strength is what separates HPP from generic, and cheaper, brands.

The current timing of their seasonal cycle does increase their chance of making a profit, but global economic turmoil and supply chain stress threaten.

Vitally, the company is under significant cash flow stress. Their available funding is equal to their loss in the last quarter. If they do not improve performance, they may be forced into liquidation, or to further extend debt.

**

HPP’s ability to repay shareholders in liquidation depends on how much they can sell the macadamia orchard for. Higher labour costs in the USA mean that production in South Africa and China is preferable to compete on the global market, and so finding a buyer could be difficult. Asia Mark Development, the holder of convertible notes and 35% of the company, are to be paid out first, further decreasing the chance of minority shareholders receiving income from the orchard sale.

On the other hand, HPP do not have a high bar to clear in terms of profit necessary to continue. If they can earn a modest profit of 2.5-3% on $30-$40m in revenue, the risk of liquidation will decline and the company should be valued higher than the current market capitalisation, on hopes of further increasing revenue through growth in macadamia demand.